Steve Marcus | Reuters

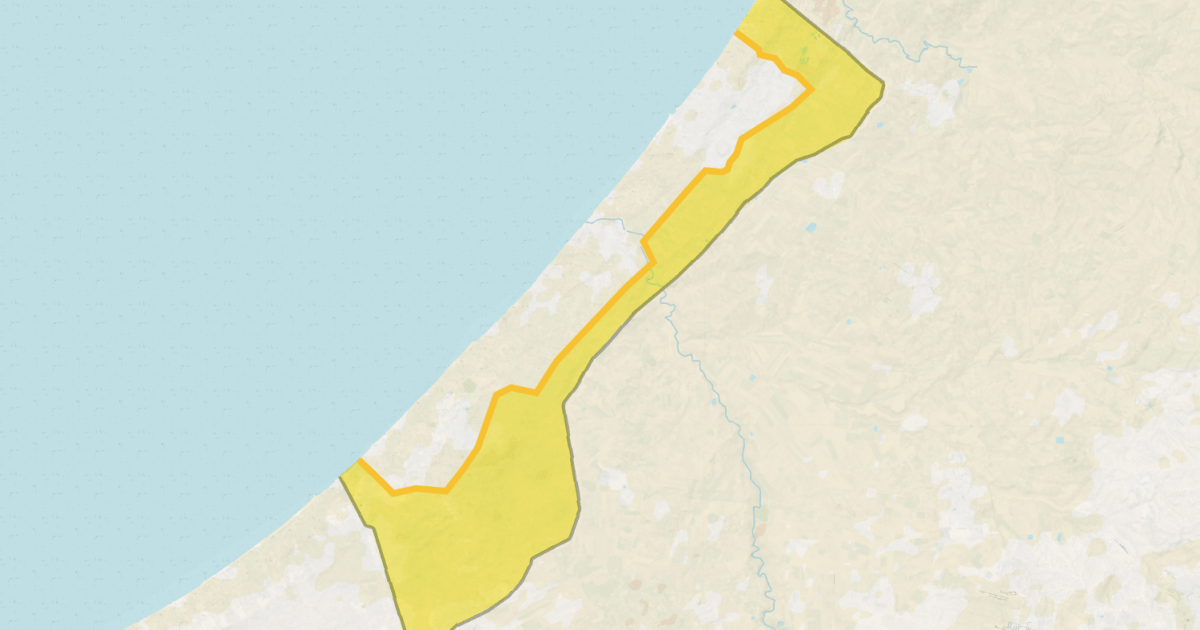

Foreign entities must now obtain a license from Beijing to export any products containing over 0.1% of domestically-sourced rare earths, or manufactured using China’s extraction, refining, magnet-making or recycling technology, the Ministry of Commerce said Thursday.

To prevent the “misuse” of rare-earth minerals in the military and other sensitive sectors, companies tied to foreign militaries or placed on export-control or watch lists will be denied permits, the commerce ministry said. Applications for items that could be used in weaponry, terrorism or other military purposes will also be rejected.

The latest move marks a “major upgrade for rare earth export control,” expanding restrictions from only raw materials to intellectual property and technologies, said Dan Wang, China director at Eurasia Group. China added several rare earths and related materials to its export control list in April.

These restrictions could further deepen other countries’ dependence on Chinese know-how while supporting Beijing’s efforts to move its own industries up the value chain, Wang added.

Chinese citizens are also prohibited from supporting overseas activities related to rare earth extraction and magnet manufacturing without approval from Beijing.

The new rules on the export of rare earth materials will take effect on December 1, while those on technologies and labor took effect immediately, according to official statements.

Applications for rare earth exports used in producing sub-14 nanometer semiconductors, advanced memory chips, semiconductor manufacturing or testing equipment, or artificial intelligence with potential military applications will be reviewed on a case-by-case basis, the ministry said.

The measures mainly target the defense sector, said George Chen, partner at The Asia Group, as part of Beijing’s efforts to dwarf the U.S. defense capabilities.

Rare earths are critical to high-tech industries, including automobiles, defense and semiconductors. Tightened access to rare earths has disrupted international supply chains caught in the U.S.-China crossfire this year.

“Beijing has realized that it has leverage in this sector and is clearly not shy about using it,” said Wendy Cutler, a senior vice president at the Asia Society Policy Institute and former U.S. trade negotiator. The move could pressure Washington to make further concessions in ongoing talks, such as tariff reductions or relaxed U.S. export controls.

Bargaining leverages

China accounts for about 70% of the global supply and has repeatedly used the critically needed minerals as a bargaining chip in trade discussions.

The latest restrictions came just weeks before a potential meeting between U.S. President Donald Trump and his Chinese counterpart Xi Jinping. The two leaders are expected to meet in person on the sidelines of the Asia-Pacific Economic Cooperation forum during the last week of October in Gyeongju, South Korea.

While China has been silent on future meetings, Trump had also said he would visit China early next year and that Xi would come to the U.S. at a later date.

The new announcement can be viewed as “a series of bargains” that Beijing wants to place even before the next round of major trade talks, The Asia Group’s Chen said.

“The Chinese side is getting more and more experienced in dealing with their counterparts and they know what their American friends want,” Chen added.

Since late last year, China has tightened restrictions on rare earth exports, including demanding proof that they will not be used for military purposes. Beijing started issuing single-use export licenses following a trade truce with Washington in May.

While China’s official data showed that exports of rare earth magnets have recovered in recent months, progress appeared uneven. The European Chamber of Commerce said in a survey released last month that Beijing’s tight grip had cost at least one member “millions of euros” while other members cited inconsistent procedures for obtaining export approvals.

A Chinese ministry spokesperson on Thursday said that there would be certain exemptions under the new rules, including exports for emergency medical situations or disaster relief. A “transition period” will also allow businesses to fulfill existing contracts and meet compliance requirements.

The transition window is likely to cushion some near-term impacts for companies, Eurasia’s Wang said, noting that “similar to how the U.S. tech export ban to China left room for American tech companies to lobby and apply for approval — most of them did get approvals.”

“It will give China more power than just a blunt ban,” Wang said.

— CNBC’s Evelyn Cheng contributed to this story.

Leave a Reply