China has driven foreign competitors in the rare earths industry out of business over the past two decades by using its global dominance in refining and processing to slash prices, Bessent said.

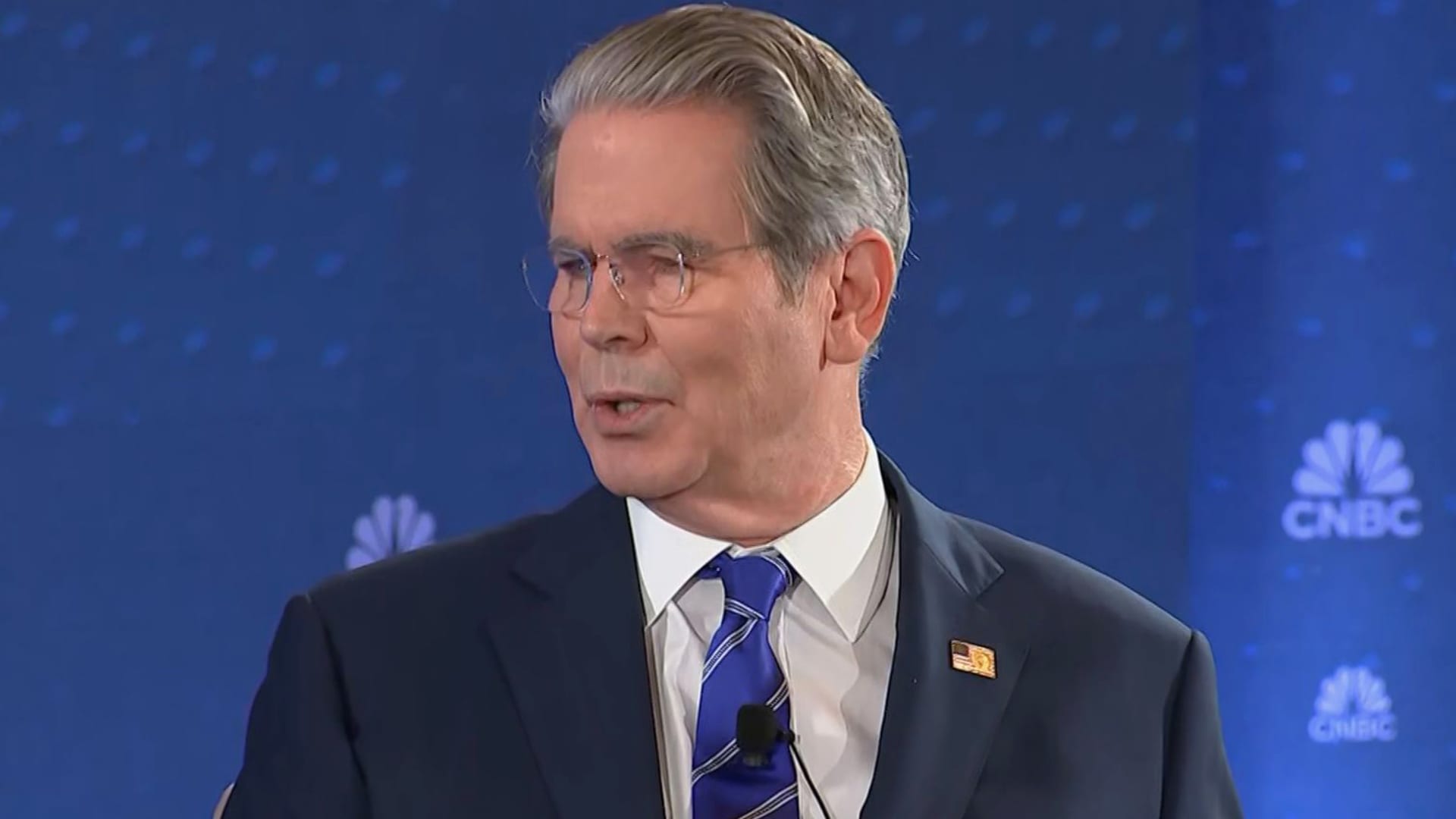

“When you are facing a non-market economy like China, then you have to exercise industrial policy,” Bessent told Sara Eisen at CNBC’s “Invest in America forum” in Washington, D.C.

“So we’re going to set price floors and the forward buying to make sure that this doesn’t happen again and we’re going to do it across a range of industries,” the Treasury Secretary said.

The U.S. also needs to set up a strategic mineral reserve, Bessent said. JPMorgan Chase is interested in working with the Trump administration to set up such a reserve, he said.

Rare earths are used to produce magnets that are crucial inputs in U.S. weapons systems like the F-35 warplane and Tomahawk cruise missiles. Rare earth magnets are also essential for civilian commercial applications like electric vehicles.

The Trump administration has been working to stand up a domestic rare earth supply chain. The Department of Defense struck an unprecedented deal in July with MP Materials, the largest U.S. rare earth miner, that included an equity stake, a price floor and offtake agreement.

China last week announced sweeping new restrictions on rare earth exports ahead of an expected meeting between President Xi Jinping and President Donald Trump in South Korea later this month. Trump has threatend to slap China with additional 100% tariffs in response.

The U.S. could take equity stakes in other companies in the wake of Beijing’s rare earth restrictions, Bessent told CNBC.

“I wouldn’t be surprised,” the Treasury Secretary said when asked about additional equity stakes. “When we get an announcement like this week with China on the rare earths, you realize we have to be self-sufficient, or we have to be sufficient with our allies.”

The Trump administration will not take stakes in non-strategic industries, Bessent said. “We do have to be very careful not to overreach,” he said.

Shares of rare earth and critical mineral miners have rallied over the past several sessions as investors speculate on which companies might be future targets for Trump administration industrial policy.

Leave a Reply