Prince Andrew was paid tens of thousands of pounds by a British businessman linked to a wealth management company which ripped off pension savers.

The King’s brother, who last week said he would no longer use his titles including the Duke of York, has long faced questions about his finances and how he is funding his lifestyle.

He stepped down as a working royal in 2019 because of his association with the sex offender Jeffrey Epstein and no longer receives any money from the King.

Although his finances remain opaque, details of some of his arrangements and controversial business associates have occasionally emerged from court cases.

Prince Andrew did not respond to requests for comment.

Documents from the High Court in London show that Andrew received £60,500 from a British businessman, Adrian Gleave in December 2019, a few weeks after the BBC Newsnight interview which led to his withdrawal from public life.

The payments came to light in a High Court case brought by an elderly Turkish millionaire, Nebahat Isbilen, who claimed money she had paid to Andrew and his ex-wife Sarah Ferguson had been misappropriated by a business adviser.

That money was funnelled through a British company owned by Mr Gleave, Alphabet Capital Limited.

According to an “agreed statement of facts signed by or on behalf of the Duke and Duchess, Mr Gleave and Alphabet”, Mr Gleave’s company Alphabet had “previously made, and might in the future make, substantial payments to HRH Prince Andrew the Duke of York”.

The payments Prince Andrew received directly from Mr Gleave and his businesses, which were also sent via Alphabet Capital, came months after the businessman had stepped down as a director of SVS Securities – a company which had been ordered to stop trading by the financial regulator over pension mis-selling allegations.

SVS Securities collapsed in August 2019, days after the Financial Conduct Authority (FCA) had ordered it to stop regulated activities.

Clients’ pension funds were found to have been invested in high-risk bonds against their interests in order to generate large commissions for SVS.

Some investments made on the basis of the undisclosed commissions then defaulted, leaving customers with substantial losses. Investors were also charged large fees to withdraw funds in an effort to boost profits, the FCA found.

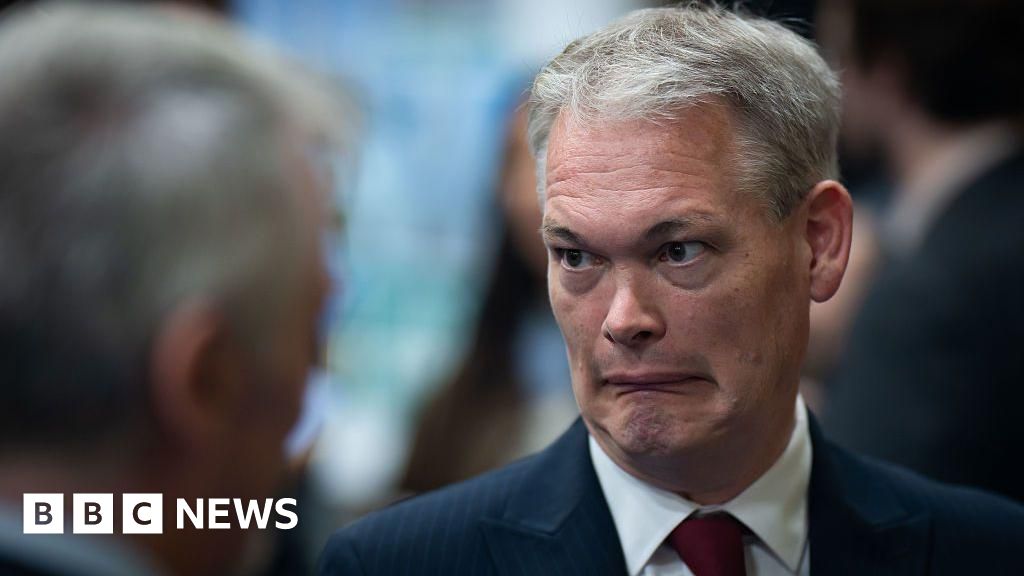

Mr Gleave, 55, was head of business development at SVS, which he had joined in 2013.

He remained a registered director on the FCA’s register until late July 2019, less than two weeks before the regulator’s intervention.

He had been a company director registered with Companies House until a couple of months earlier, although on LinkedIn he claims to have left the business in November 2018.

Three SVS directors were later banned and fined by the FCA but Mr Gleave was not one of them. Two are appealing the decision.

The Financial Services Compensation Scheme has paid out more than £41m to former SVS customers.

At the time of his dealings with Prince Andrew, Mr Gleave also ran a number of caravan and mobile home parks in Northern Ireland and England.

At one point, he was reported to have worked out of one of the parks, a retirement village for over-55s on the east coast of Northern Ireland.

Ten of the parks have since gone into administration and Mr Gleave, who did not respond to a request for comment, now works for a renewable energy company with a focus on AI and crypto financing.

Neither Prince Andrew nor Mr Gleave have ever explained the reason for the payments or the nature of any contractual relationship between the two men.

Baroness Margaret Hodge, a former chair of the Commons public accounts committee, said Mr Gleave’s business background raised questions for Prince Andrew about his judgement and financial dealings.

“This is yet another instance where a dose of transparency would help answer legitimate questions about the origins of the money and the purpose of the payment,” she said.

“Without those answers any sceptical person would be worried that there might be some financial wrongdoing taking place and this would risk sullying the reputation of the Royal family,” she added.

As well as the payments he made himself, Mr Gleave’s company, Alphabet Capital, was also used to funnel significant sums which had originated from Ms Isbilen to Prince Andrew and his ex-wife Sarah, court documents show.

Ms Ferguson was paid £50,000 by Alphabet Capital in February 2020. It has previously been reported that she was paid £20,000 by Alphabet for a role advising the company and that she also received more than £200,000 to cover work she had done as a brand ambassador for a US solar energy company.

Prince Andrew was separately given £750,000 directly by Ms Isbilen, money which he has repaid.

Another £10,000 was paid from Alphabet Capital to the couple’s daughter, Eugenie. This, along with a £15,000 payment from Ms Isbilen’s business adviser has previously been described by Eugenie as a gift from a “long-standing family friend” which she said was to pay for a surprise birthday party for her mother, Sarah.

Alphabet Capital filed accounts claiming it was a dormant company at the time of the payments. These were later corrected but listed a turnover of just £80,000.

Prince Andrew and Mr Gleave did not respond to requests for comment.

Leave a Reply