Spain has figured out how to turn its creative talent into serious global business. In a joint presentation at Mipcom, leading entertainment research company Parrot Analytics and Spanish Trade & Investment entity ICEX, revealed new data that shows the Southern European country as one of the most efficient and reliable sources of hit content in the world.

Spurred by generous federal and regional incentives, production has boomed in Spain, with more shows increasing in terms of both quality and volume. The Spanish government’s active investment in the TV and film industry has bolstered local creators and also attracted foreign productions to shoot in Spain. A growing number of Latin American producers are also setting up outposts in Madrid in a bid to tap the country’s incentives, caché and co-production treaties with a number of countries.

Spain even opened a support office in Singapore to boost their presence in Asia where demand is up 63% from last year, accring to a report to be revealed at the annual confab in Cannes. The surge in Asia includes standout gains in Singapore (+127%), China (+75%) and India (+61%).

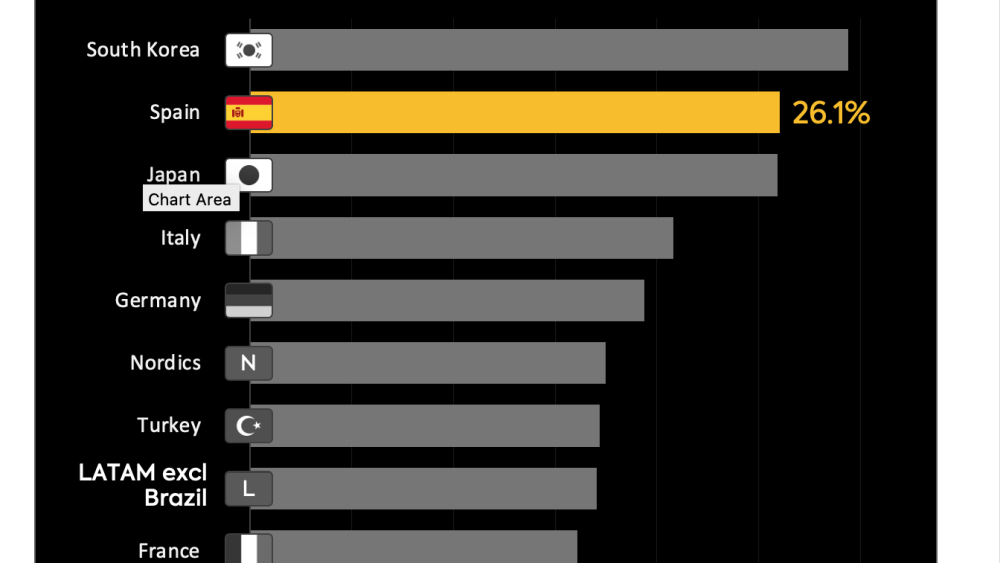

“Streamers need reliable bets,” said Jaime Otero, VP Partnerships, Parrot Analytics. “Spain’s 26.1% hit-rate – highest in Europe and Latin America, second only to Korea – combined with +63% Asia demand and clear subscriber impact across all major streaming services, shows a slate that is both broad and bankable. This level of insight-re-risks investment, increases financial upside and separates the leaders from the rest.”

“This data is the definitive proof that our strategic investment in the audiovisual sector is delivering a remarkable return for Spain,” said Luis Mayoral Gabaldón, director for creative industries at ICEX.

“A world-class hit-rate isn’t an accident; it reflects a deliberate national focus on excellence and innovation. A few years ago, we proved that our productions could scale and travel beyond our local market; we are now demonstrating a connection of our content across audiences, platforms, territories and genres that our global partners can bank on.”

Otero pointed out that the Spanish audiovisual industry no longer relies on a few tentpole hits as some years ago but offers a broader diversity of content that performs well across all platforms and regions. Last year, J.A. Bayona’s Oscar-nominated “Society of the Snow,” Netflix series hit “Money Heist” and Prime Video’s “Red Queen” turbocharged the success of Spanish content globally.

Jaime Otero, VP Partnerships, Parrot Analytics

“The share of Spanish titles accounting for 80% of Spain’s global streaming revenue, has nearly doubled since 2020 (from 7.0% to 13.5% in H1 2025),” per the report.

Details unveiled at Mipcom on Oct. 13, included the following:

- Global revenue share: Spain accounts for 6.47% of global non-English streaming revenue (period 2022 to 2025 H1)

- Prime Video: “Apocalypse Z: El principio del fin” is the #1 non-English movie for subscriber acquisition globally since 2024, with 1.1M total global subscribers engaged in its first window (over the first 13 weeks post-release)

- Disney+: “Invisible” and “Cristóbal Balenciaga” each ranked among the top 15 non-English series for acquisition and retention in their first 13 weeks

- Netflix: “Carlos Alcaraz: A mi manera” was a top-5 non-English documentary for acquisition in its first 10 weeks

This year’s analysis builds on the $5.1B revenue baseline reported at MIPCOM 2024, reflecting Spain’s tactical shift from promotion to data-validated ROI (Return on Investment).

Mipcom runs Oct. 10-16.

Courtesy of ICEX

Leave a Reply