Every weekday the CNBC Investing Club with Jim Cramer holds a “Morning Meeting” livestream at 10:20 a.m. ET. Here’s a recap of Thursday’s key moments. 1. The stock market was lower Thursday, with the S & P 500 and Nasdaq both retreating from their previous record-high closes. This comes after Wednesday’s furious rally in the AI trade names. Jeff Marks, director of portfolio management for the Club, pointed out consumer discretionary and industrials as the weakest sectors in Thursday’s session. A bright spot, however, was Delta Air Lines , which posted a strong quarter. Delta shares jumped 4.5%. It’s a good read-through for Club name Boeing . “A strong airline is good for the aerospace industry,’ Jeff said. To be sure, shares of Boeing were falling nearly 4% on Thursday, following a three-session win streak. 2. Nvidia shares rose 2.5% on Thursday after Cantor analysts increased their price target to $300 from $240. That is a Street high PT, representing roughly 55% upside from Nvidia’s current share price of around $194. If achieved, this would send the AI leader’s market cap to over $7 trillion from its present valuation of $4.6 trillion. Simply put, Cantor sees no evidence of an AI bubble as hyperscaler spending grows. Nvidia CEO Jensen Huang pushed back on the idea of an AI bubble during October’s Monthly Meeting with Jim Cramer. 3. Portfolio names Disney and Broadcom both made Goldman Sachs’ list of tactical trade ideas heading into earnings season. The analysts are expecting an EPS beat from Disney, driven by direct-to-consumer profitability and domestic parks. As for Broadcom, the analysts said the custom chipmaker’s large $110 billion backlog provides a lot of visibility for the next two years. On last month’s post-earnings conference call, Broadcom said it secured $10 billion in orders from a customer widely believed to be OpenAI. (Jim Cramer’s Charitable Trust is long AVGO, BA, DIS, NVDA. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

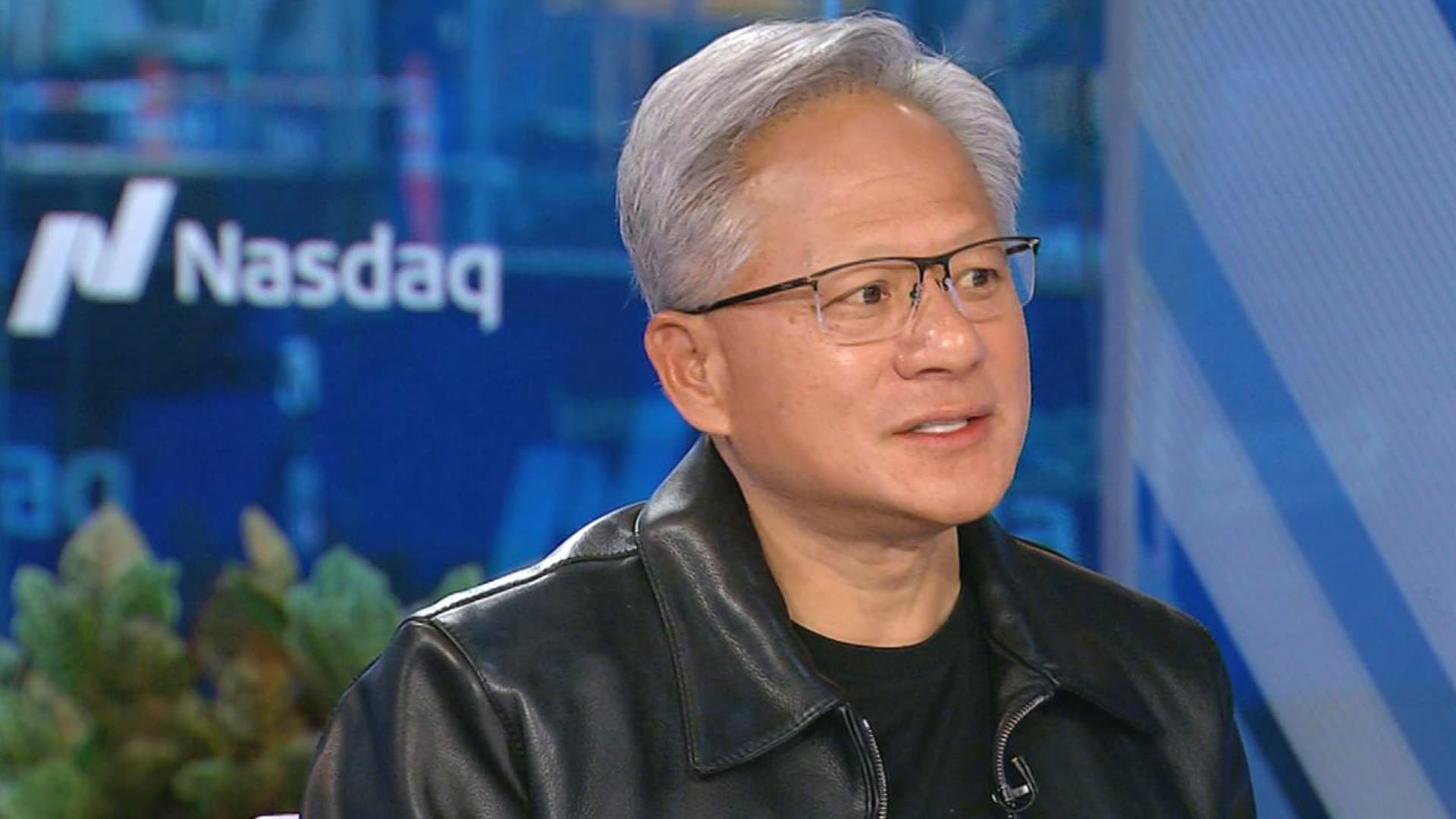

Leave a Reply