Melissa Repko | CNBC

Target’s creative team has traveled the world to find inspiration for its brands, from a rodeo in Colorado to ski lodges in the French Alps and restaurants in New York’s Hudson Valley.

With global trips, an artificial intelligence-powered tool and sharper critiques of its own merchandise, the big-box retailer wants to get back to its roots: designing attention-grabbing, fashion-forward clothing and home decor at an affordable price.

Target’s merchandise was once a competitive advantage, but even the company admits it has lost that edge. The big-box retailer’s sales have declined in some categories that it’s best known for, such as home goods, as competitors lure away customers.

As consumers’ enthusiasm for Target’s offerings has faded, annual sales have been roughly flat for four years, and the company expects sales to decline this year. Shares of Target have tumbled about 35% in the last year, as its own merchandising issues, a sloppier store experience and boycotts over its rollback of diversity, equity and inclusion programs all weigh on its business. Discretionary items, long a strength for Target, have also become a tougher sell for shoppers, as groceries and rent hit household budgets.

The company is undergoing major changes as it tries to reverse its struggles. Last week, the retailer announced it would cut 1,800 corporate jobs — its largest round of layoffs in a decade.

Target is also gearing up for a leadership transition. Michael Fiddelke, the company’s chief operating officer and former chief financial officer who has spent two decades at the company, will start as Target’s CEO in February as Brian Cornell retires.

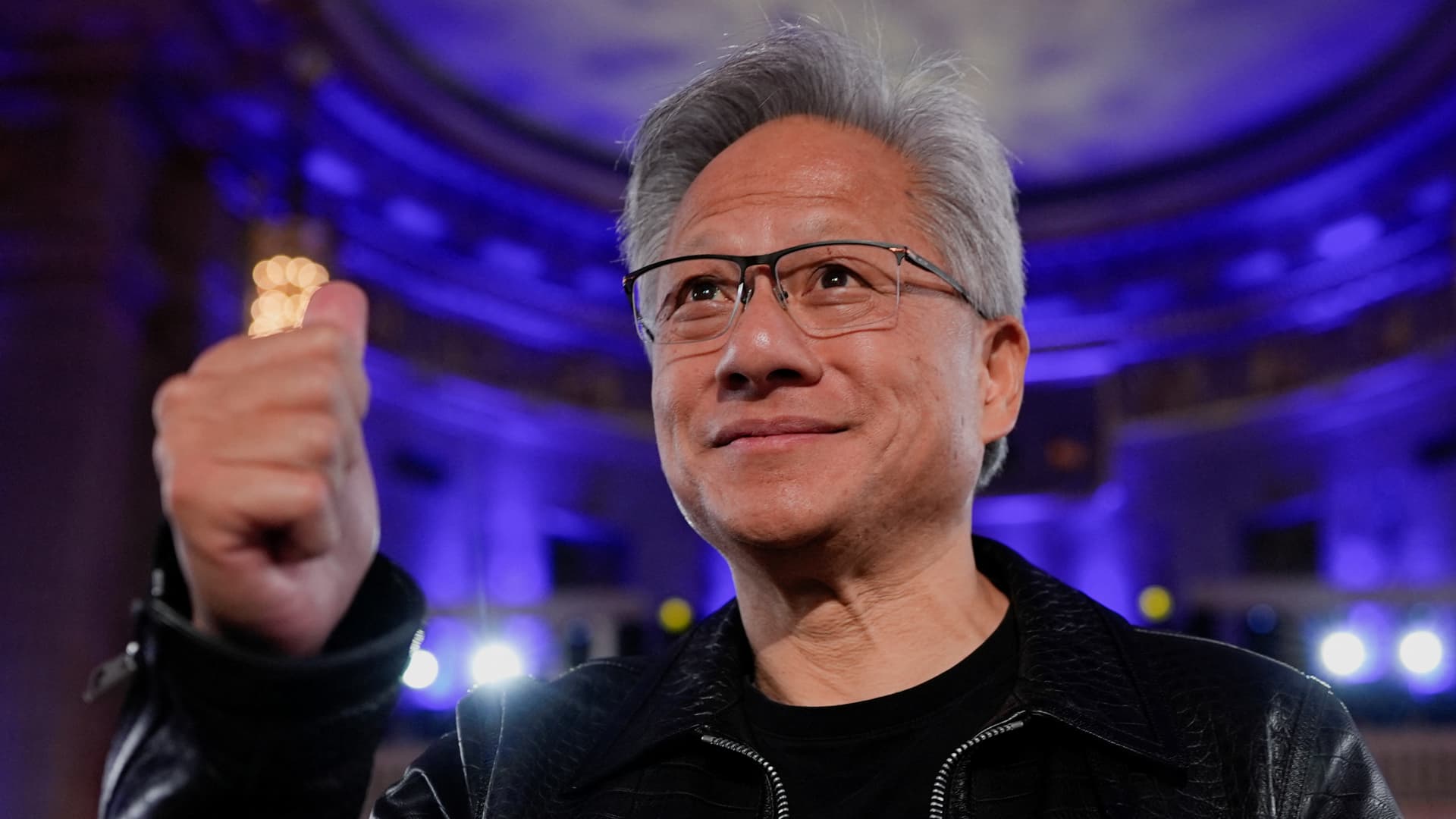

Target CEO Michael Fiddelke poses for a portrait at Target headquarters in Minneapolis, Minn. on Tuesday, June 24, 2025.

Elizabeth Flores | The Minnesota Star Tribune | Getty Images

In an interview with CNBC at Target’s Minneapolis headquarters, Fiddelke outlined his three key priorities as he steps into the company’s top job: regaining Target’s reputation for style and design, providing a more consistent customer experience and using technology to speed along the business.

He said elevating Target’s merchandising authority — which earned it the nickname “Tarzhay” among shoppers — “is a critical first priority for me.”

“When we lead with style and design, when our guests can walk into a Target store or scroll through the app and find that stylish, unique thing that ideally they could only find at Target, that’s at an unexpected value, that’s when we’re at our best,” he said.

The crucial holiday shopping season will test whether Target’s efforts to refresh its merchandise are bearing fruit. Nearly a third of its annual sales came from the holiday quarter last year.

Yet to draw eyeballs to fresh merchandise, Target will have to overcome a fundamental challenge: Fewer shoppers are coming to its stores.

Target’s store traffic has fallen nearly every week since late January, according to Placer.ai, an analytics firm that uses anonymized data from mobile devices to estimate visits to locations. In September, monthly store traffic declined by 7.6% year over year across Target’s locations — its steepest decline since February, the firm found.

Customer transactions and the average amount shoppers spent when they visited Target’s stores or website dropped year over year in the retailer’s most recently reported fiscal quarter, which ended Aug. 2.

Oliver Chen, a senior equity research analyst who covers retail and luxury goods for TD Cowen, said Target’s competition from a wide range of retailers, including TJMaxx, Shein and Amazon, has grown fiercer. Plus, social media means trends move faster than before — forcing Target to adapt to stay ahead.

“It’s not like they disappeared, but if you and I were the same and we didn’t change, we would be less relevant in the age of TikTok,” he said. “You can’t stand still.”

For the holiday quarter, Target is trying to capitalize on fresh merchandise to attract shoppers. Fiddelke said Target will have 20,000 new items in the fourth quarter, double what the company had a year ago.

Target launches limited-time collections with brands to try to fuel shoppers’ excitement and create buzz. It recently launched a collection with Woolrich, a Pennsylvania-based outdoorswear company with items including sweaters, pancake mix and camping chairs.

Melissa Repko | CNBC

Out with the basic and beige

Neon footballs, 1980s-themed Doritos and an aisle of colorful Owala waterbottles with mix-and-match lids.

On a recent store tour in Edina, a suburb of Target’s hometown of Minneapolis, Chief Commercial Officer Rick Gomez pointed out those examples of Target’s fresher approach to merchandise for the fall and holiday season. He said the colorful assortment marks a shift from the past few years, when Target’s merchandise became “too basic” after the pandemic.

“Everybody was quarantined,” he said. “Nobody was traveling. Nobody was out there getting inspired. Our designers were stuck at home. Our merchants were stuck at home. We weren’t seeing new fabrications, new silhouettes, new trends. We didn’t have our finger on the pulse of consumer culture, what was trending, what was happening. We lost touch.”

He added that when Target got stuck with too much of the wrong stuff as people’s spending shifted after the pandemic, its team reacted by “making conservative decisions,” not only about the size of orders but also about the styles they picked.

For example, Target’s back-to-college collection in fall 2024 included mostly neutral-colored and gray dorm accessories and furniture — and performed poorly. The company reversed that approach this fall, adding back “mix-and-match” dorm decor for a wider range of styles “across everything from preppy, glam [and] modern,” Gomez said. That led to higher sales.

“It was a proof point to us that, let’s get back to listening to the consumer, trusting our instincts, and then leaning into style and design,” he said.

Kiosks display copies of the new Taylor Swift album “The Life of a Showgirl” at a Target in Watertown, MA on October 5, 2025.

Jason Bergman | Sipa USA | AP

Now, Gomez said he’s trying to embolden merchants and designers to “unleash your creativity.”

“We cannot be a leader in style and design if we’re going to be playing it safe, if we’re going to be conservative, if we’re going to live in a world of neutrals,” he said.

Those efforts go beyond clothing and home goods. Among its recent moves, Target launched a collection inspired by Netflix’s “Stranger Things,” timed to coincide with the TV series’ final season, including T-shirts, action figures and Chips Ahoy, Doritos and Frosted Flakes with 1980s labels. This fall, it has a limited-time collaboration with Pennsylvania-based outdoorswear company Woolrich with red-and-black checkered shirts, camper chairs, and pancake mix, among other items. And as Taylor Swift’s new album launched, it opened stores at midnight so customers could get their hands on exclusive vinyls and CDs of “The Life of a Showgirl.”

Yet Gomez said Target’s changes will take time, and some will not take hold until next year. In particular, he said Target needs to revive sales in its home and hardlines categories.

Target has renamed hardlines to Fun101, a category that includes items like sporting goods, TVs and laptops. It has also slimmed down the number of bulky and basic items that it sells, such as carrying fewer bicycles, TVs and printers, and more items where it can stand out on style or design, like water bottles, coolers and tech accessories, he said.

Target is trying to refresh its home category with new collaborations, including Marvel- and Disney-themed bedding for its kids’ home line, Pillowfort, which launched in February.

He said home is another area of the store that needs “major work,” in both its products and experience. In the spring, Target will give its largest private label home brand, Threshold, a new look.

It’s tried to refresh the home category in the meantime with three new collaborations this year: Disney- and Marvel-themed kids’ bedding collections for its private brand Pillowfort; a line of bedding and bath items from direct-to-consumer brand Parachute; and a collaboration with “Queer Eye” star Jeremiah Brent, which will launch in December.

Target’s own brands — which are sold only on its website and stores — are a critical part of how it stands out. Along with selling national names like Levi’s, it has more than 40 of its own brands, including kids’ clothing brand Cat & Jack, activewear line All in Motion and a new floral line called Good Little Garden. Target private brands drove about $31 billion in sales last year, accounting for nearly 30% of its annual net sales.

Target is turning its store in New York City’s SoHO neighborhood into a new concept that shows off more of its fashion-forward, unique merchandise. The store, shown in a company rendering, will have bolder displays that rotate.

Courtesy of Target

A new style display

One of the clearest illustrations of Target’s effort to regain its reputation for style and design will land soon in New York City’s SoHo neighborhood at the corner of Broadway and Houston St.

Starting in November, the big-box retailer is turning that neighborhood store into a new concept that shows off more of its fashion-forward, unique merchandise and carries less of its convenience-store staples like toothpaste, shampoo and snacks, Chief Guest Experience Officer Cara Sylvester said.

Target chose the location because it sits in an influential global style capital and has higher foot traffic, Sylvester said. She added the store will feel more like a “pop-up shop,” with Target rotating merchandise monthly and showing off its products — such as fashion-forward clothing and home collaborations — in “bold, iconic displays.”

Even beauty items and basics will look different, as Target plans to show them off in a more “stylized way,” she said. And the retailer may expand aspects of the concept store to other locations, she said.

“It’s a really important place for us to say ‘This is who Target is,'” Sylvester said. “And we want to really evoke that sense of discovery.”

Behind the scenes, Target is enlisting a new tech tool to spot and react to trends faster. Early this year, it began using Target Trend Brain, a generative artificial intelligence-powered tool built to help the company’s designers and merchants identify the colors, materials and silhouettes that customers want and move more quickly to turn those insights into items.

Instead of having employees manually review and tag images from fashion runways, the AI-powered tool can help synthesize photos to forecast what will be popular in the coming seasons. For instance, Target used the tool to reinforce its initial forecast that greens, berries and blues would be the must-have colors of the fall and winter.

Jenny Breeden, Target’s senior vice president of product design and packaging, said the tool allows Target’s trend and design teams to do a “pulse check” closer to when they set merchandise for a season and make adjustments.

Target is trying to regain its reputation for creative and unique merchandise this holiday season. One example of its new items is its plush charcuterie sets from Target’s toy brand, Gigglescape.

Melissa Repko | CNBC

Some of Target’s creative designs will soon hit shelves: charcuterie-inspired plush sets for kids from Target’s private label toy brand, Gigglescape; subtle Western-inspired tops for its womenswear line Universal Thread; and gifting options like assorted chocolate truffles from one of its food brands, Favorite Day.

Yet as Target tries to regain its reputation for affordable style, some of its freshest ideas for holiday gifts and winter apparel have come from employees getting out in the world, Breeden said. As the merchants and designers traveled, they observed textures, fonts, graphics and other details that they took back to Target’s design studio in Minneapolis.

Those trips resumed after the Covid pandemic, but with a new spin, she said. Instead of traveling with just one category’s team, Target is bringing employees across categories. For example, the company sought ideas in European ski resorts and holiday markets for both apparel and home.

She said the team also wants to get closer to its customers and the trends influencing them, even going to college dorms and tailgates and attending music festivals.

“We really realized that we needed to go deeper and go to the real source of where the trends were emerging, because culture is moving so fast,” Breeden said. “Gone are the days where you wait for Fashion Week and see how it trickles through.”

“It’s pretty incredible how eye-opening that is when you’re really there in it, versus seeing it from an artist’s distance,” she said.

Leave a Reply