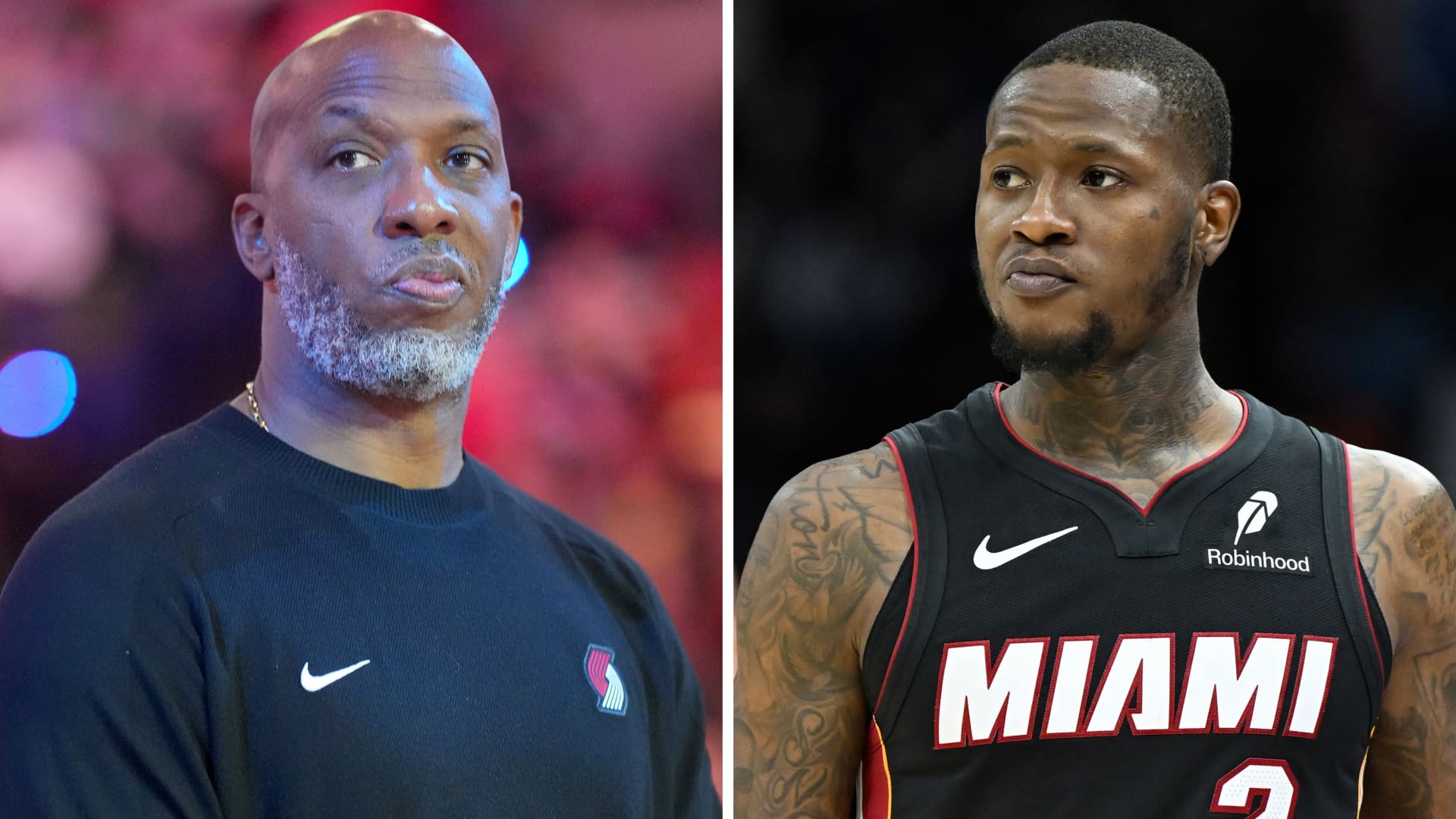

Ben Kriemann | Getty Images

- Earnings per share: $4.13 adjusted vs. $3.67 per share expected

- Revenue: $77.67 billion vs. $75.33 billion expected

Revenue increased 18% in the fiscal first quarter from $65.6 billion a year ago, according to a release. Net income rose to $27.7 billion, or $3.72 per share, from $24.67 billion, or $3.30 per share, during the same period last year.

Microsoft said its investment in OpenAI resulted in a $3.1 billion hit to net income in the quarter, equivalent to 41 cents per share.

Microsoft’s Intelligent Cloud unit, which includes Azure, reported $30.9 billion in revenue, up 28% from a year ago and above the StreetAccount consensus of $30.25 billion. Growth in Azure, which competes with Amazon Web Services and Google Cloud, also beat estimates, as analysts polled by StreetAccount had anticipated 38.2% expansion.

Cloud continues to be the big driver of growth at Microsoft, as the business has proven to be a major beneficiary of the AI boom. Last quarter, Microsoft disclosed the scale of its Azure cloud infrastructure business in dollars for the first time. The company said revenue in fiscal 2025 from Azure and other cloud services jumped 34% from the prior year to more than $75 billion.

For the fiscal second quarter, Microsoft said on the earnings call that expects revenue in the range of $79.5 billion to $80.6 billion. The middle of the range is $80.05 billion, while analysts were expecting $79.95 billion, according to LSEG.

The company said it expects Azure growth at constant currency will be 37% in the fiscal second quarter, inline with estimates.

Investors were listening closely for Microsoft’s commentary on capital expenditures as the company races to build out the infrastructure necessary to support AI demand. CFO Amy Hood said capex for the first quarter came in at $34.9 billion. She told investors in July that the company expected to spend $30 billion in capex and assets acquired through leases during the quarter.

Hood said that the capex growth rate for fiscal 2026 will be above the rate in 2025. She’d previously said there would be a slowdown in growth.

Microsoft’s Productivity and Business Processes segment, which is home to Office productivity software and LinkedIn, delivered $33 billion in revenue for the first quarter, above the $32.33 billion consensus among analysts polled by StreetAccount.

The More Personal Computing unit, which includes Windows, search advertising, devices and video games, reported 4% growth to $13.8 billion in revenue. That was above StreetAccount’s $12.83 billion consensus.

Microsoft’s earnings landed hours after the company experienced an outage in Azure and its 365 services. Various websites and games were down for hours, and Microsoft said it expects recovery by this evening.

Microsoft shares are up 28% this year, as of Wednesday’s close, and hit a record a day earlier. Much of its AI momentum has been attributed to its tight relationship with OpenAI.

On Tuesday, OpenAI announced it has completed its restructuring and formally outlined Microsoft’s stake in the company. Under the new structure, OpenAI’s nonprofit will hold a 26% stake in its for-profit arm, worth about $130 billion. Microsoft will hold a 27% stake worth about $135 billion, and current and former employees and investors will own the remaining 47%.

This is breaking news. Please check back for updates.

WATCH: Microsoft market cap jumps to $4 trillion

Leave a Reply