Every weekday the CNBC Investing Club with Jim Cramer holds a “Morning Meeting” livestream at 10:20 a.m. ET. Here’s a recap of Tuesday’s key moments. 1. The stock market is slightly higher on Tuesday. Investors “just want to wait for what happens with the trade talks,” Jim Cramer said, as U.S. and Chinese officials meet for a second day in London. “I beg to differ,” Jim said, explaining that there are other dynamics in the market to follow closely. That includes tame interest rates and a pickup in oil prices. “The economy may not be hurt as badly as we think,” Jim said. “You have to start thinking beyond tariffs and saying that there are a lot of companies that have adjusted to it and that we are pricing them in.” 2. Taiwan Semiconductor Manufacturing Co. shares are up a little over 2% after reporting solid May sales Tuesday morning. Wedbush analysts said TSMC’s second-quarter revenue is on pace to exceed estimates, a positive sign for Club name Nvidia , which relies on the company to make its leading AI chips. Shares of Nvidia aren’t moving much Tuesday, but Jim said that’s because the company is “caught in the vortex of the trade talks.” Director of Portfolio Analysis Jeff Marks noted that DuPont’s electronic business supplies to TSMC, so the sales data is a positive sign for that Club name. “It’s a good sign for everything [in the chip industry],” added Jim, citing positive stock reactions from AMD , Texas Instruments , and Micron . 3. Meanwhile, Texas Roadhouse shares fell roughly 2.5% Tuesday after announcing the departure of CFO Chris Monroe. While this kind of news always catches our eye, Jim said the company’s statement suggests Monroe was not fired for cause and is simply moving back to Texas after two years at the Kentucky-based restaurant chain. Given the way the stock is reacting, Jim said: “You buy Texas Roadhouse if you don’t already own it.” The company is searching for a successor, while its vice president of finance, Keith Humpich, serves as the interim CFO. The Club made its last two purchases of Texas Roadhouse in April amid tariff turmoil, then booked some profits in May. 4. Stocks covered in Tuesday’s rapid fire at the end of the video were: JM Smucker and Casey’s General Stores . (Jim Cramer’s Charitable Trust is long AAPL, DD, NVDA, TXRH, See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

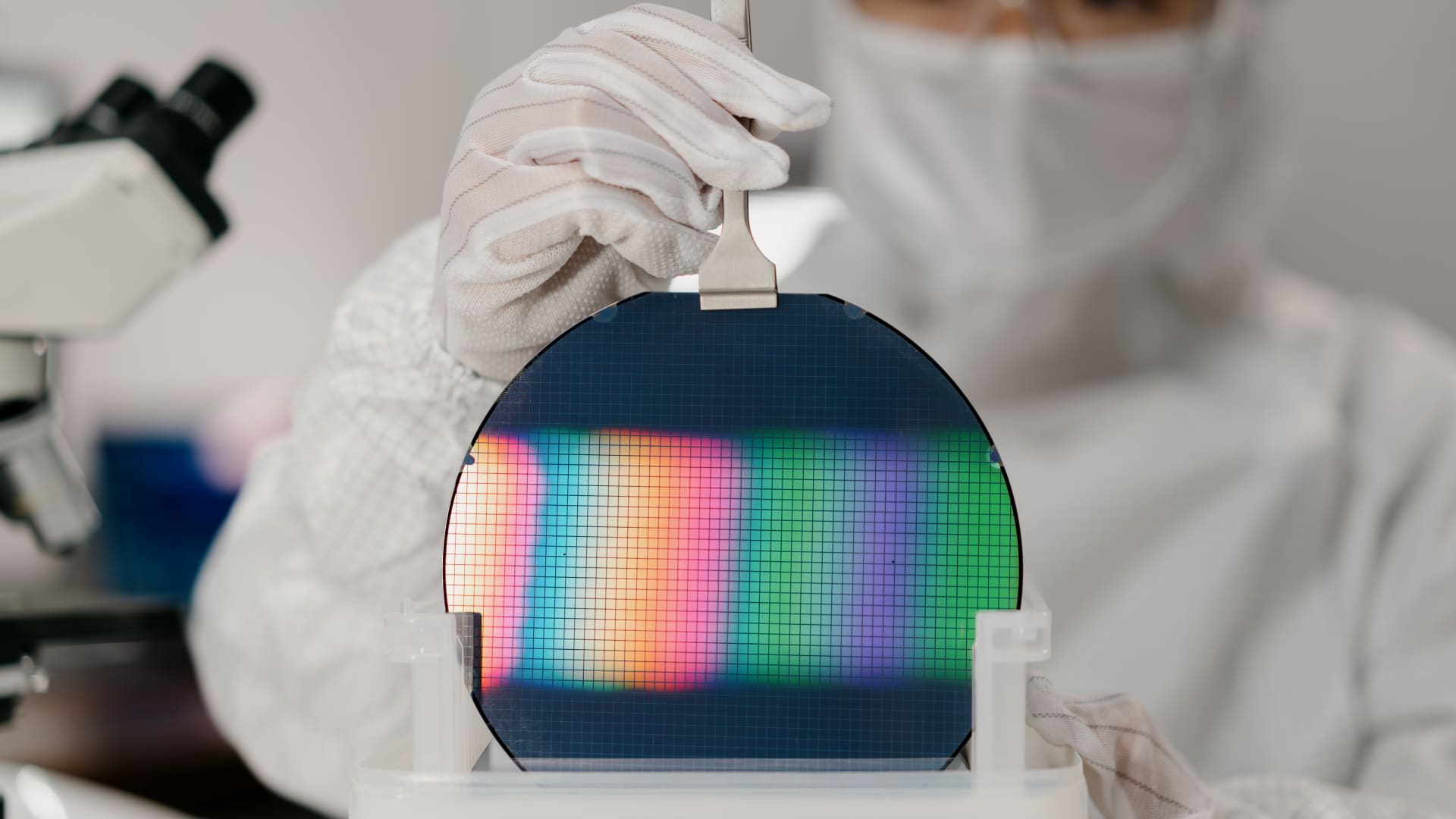

Leave a Reply