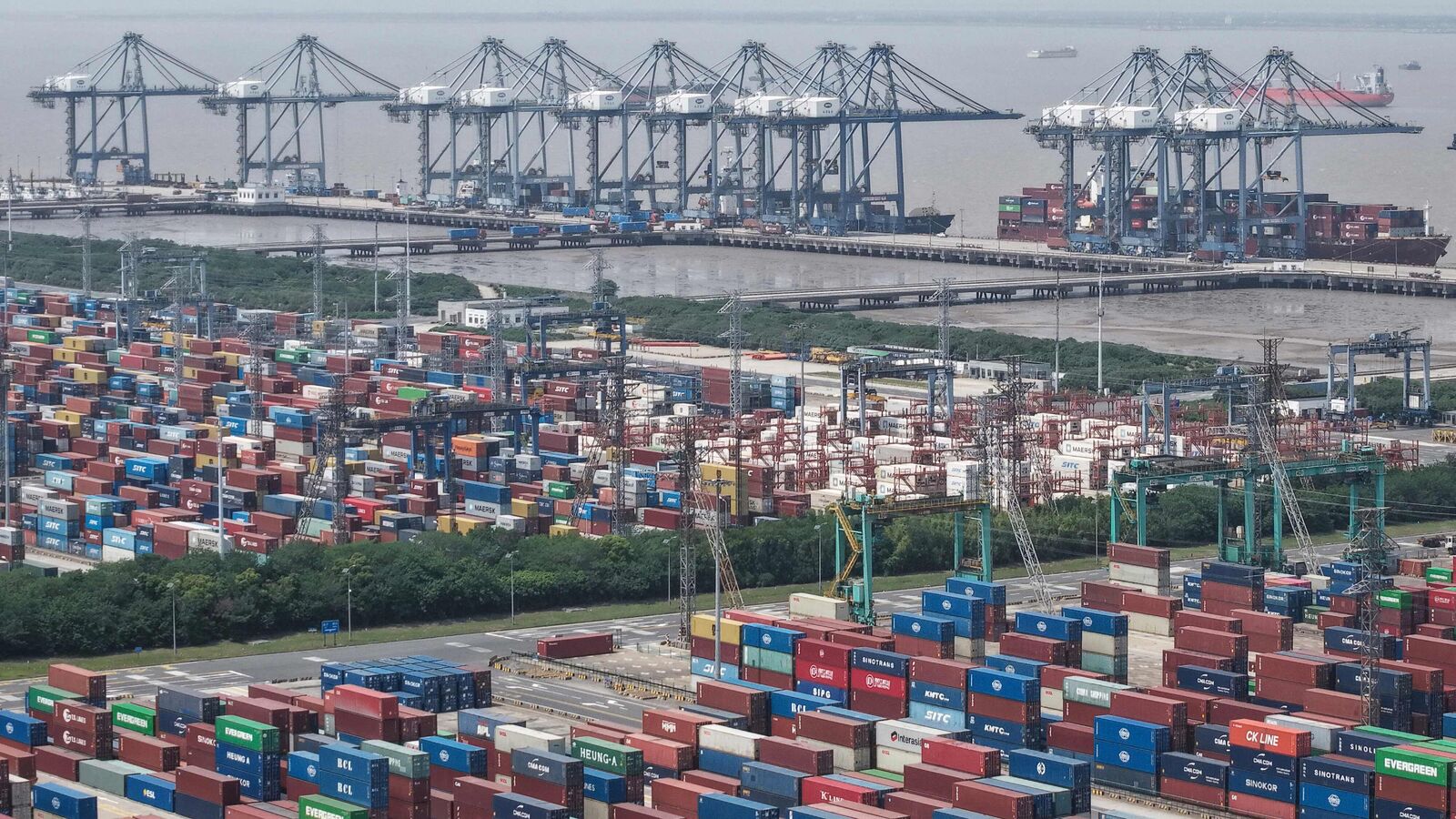

Indeed, trade agreements and deeper and wider trade treaties between countries and blocs have progressively increased.

A World Trade Organization (WTO) database shows that 375 regional trade agreements (RTAs) between two or more countries are currently in force, with another 36 in the works. Of the active RTAs, 241 have come into effect over the past two decades. Since many are multilateral, the number of unique country pairings covered by these agreements stands at around 5,500.

Read this | What is India’s advantage in the global trade reset amid US’s tariff flip-flops?

India is part of 19 RTAs. One such is with the United Arab Emirates (UAE), beginning February 2022.

In 2024-25, the UAE, whose population is less than India’s capital city, accounted for about $37 billion, or about 8%, of India’s exports. Reliance Industries, India’s largest conglomerate, set up a trading hub in the UAE about four years back.

Developed economies lead in entering into RTAs. On average, they have signed thrice the number of RTAs as developing ones, while being more evenly matched in terms of the number of partners. And increasingly, in such agreements, they are pressing for a reduction of non-tariff barriers.

RTA boost

As per a WTO working paper by Rohini Acharya and Thakur Parajuli, the share of global imports from RTA partners increased from 37% in 2010 to 52% in 2022. In the past couple of years, the number of RTAs being signed has slowed, except in 2021, when the UK signed a slew of trade agreements in the aftermath of its decision to leave the European Union (EU).

Read this | Mint Exclusive: India-US trade deal before 8 July, talks next week

At present, EU countries lead in RTAs, while India is ranked 11th, behind China.

Among RTAs signed in recent years, one is tipped to be watched for its impact in the years ahead: the Regional Comprehensive Economic Partnership (RCEP), which came into force in January 2022. The RCEP comprises 15 East Asian and Asia-Pacific countries, led by China, Japan, South Korea and Australia. The 15 member-countries account for 30.5% of the world’s GDP. By comparison, the European Union accounts for 18% of global GDP.

Beyond tariffs

RTAs are increasingly cutting across regions (for example, India-UAE), rather than pivoting around regions (India-Asean).

Read this | India, Asean trade agreement review faces delays

At present, about two-thirds of RTAs are cross-regional. The other change is a move beyond tariffs to also cover policy domains related to trade and foreign investments, like competition policy, government procurement rules and intellectual property rights. For their broader nature, they are referred to as ‘deep trade agreements’.

According to a paper by UN Trade and Development (UNCTAD), overall export growth shrank by 13.8% in 2020, the first covid year. Among countries with no RTAs, it declined by 14.1%. But, among those with deep trade agreements, the drop was a lower 8.5%.

“One possible explanation…is that trade flows within RTAs are under more robust conditions and have lower trade costs relative to trade outside RTAs (e.g. lower tariffs and more intensive cooperation in other areas such as trade regulations and investment regimes),” say the authors Alessandro Nicita and Mesut Saygili.

Give and take

India is placed low on the inclusion of policy areas other than tariffs in trade agreements.

According to a database maintained by the WTO, India is ranked 152nd, with an average depth (number of policy areas covered) of 7.2 among the 19 trade agreements signed with 53 countries. By comparison, China and Vietnam have an average depth of 14.6 and 15.7, respectively.

This point is also borne out when compared to the US on coverage of key non-tariff domains in their respective domains.

Also read | Asian factories bear scars of Trump’s tariff blast

Some of the ring-fencing by India is from the point of view of protecting key stakeholders—for example, farmers in the context of agriculture markets and cost of medicines in the context of intellectual property rights. This is also the tightrope that India has to walk in trade agreements, as it needs those export markets and foreign capital in high-end and export-oriented sectors.

www.howindialives.com is a database and search engine for public data

Leave a Reply