When the deal closes, it will create the ninth-largest U.S. bank — with roughly $288 billion in assets. The transaction is expected to finalize in the first quarter of 2026.

“This combination marks a pivotal moment for Fifth Third as we accelerate our strategy to build density in high-growth markets and deepen our commercial capabilities,” Fifth Third CEO Tim Spence said in a release.

Comerica shares rallied 11.5% in the premarket following the announcement. Fifth Third lost about 3%.

CMA and FITB 5-day chart

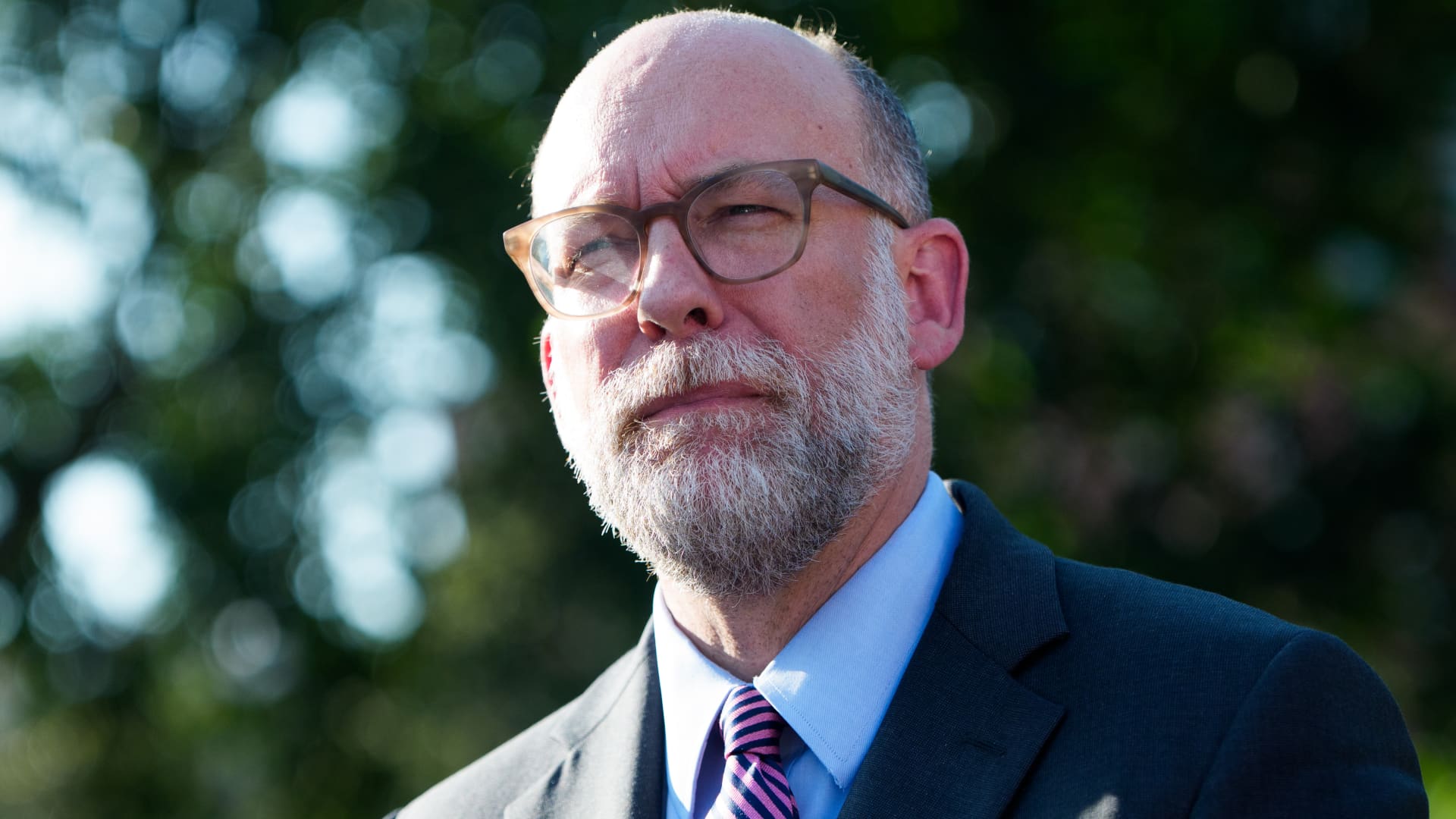

“Joining with Fifth Third – with its strengths in retail, payments and digital – allows us to build on our leading commercial franchise and further serve our customers with enhanced capabilities across more markets,” Comerica chief executive Curt Farmer wrote.

The SPDR S&P Regional Banking ETF (KRE) jumped 1% in early trading on expectations this deal will be the start of many more in the reginal banking space as the Trump Administration and Republicans ease regulations and takeover scrutiny.

Leave a Reply