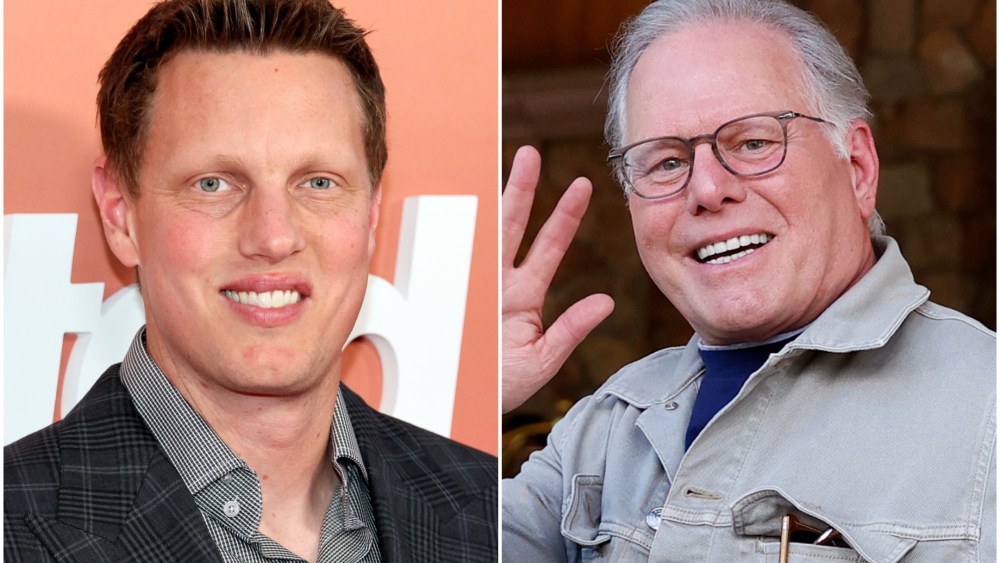

For now, David Ellison’s Paramount Skydance is signaling that it will fight for the hearts and minds of Warner Bros. Discovery with the $30/share offer it has already put forward — and that it won’t go higher.

After WBD’s board officially rejected Paramount’s offer, Paramount issued a statement saying it “affirmed its commitment to acquiring” Warner Bros. Discovery in its entirety for $30 per share in cash. The stance indicates that Paramount is preparing for a drawn-out fight for shareholder votes against the Netflix deal to buy Warner Bros. studios and HBO Max.

David Ellison, chairman and CEO of Paramount, said: “We remain committed to bringing together two iconic Hollywood studios to create a unique global entertainment leader. Our proposal clearly offers WBD shareholders superior value and certainty, a clear path to close, and does not leave them with a heavily indebted sub-scale linear business. I have been encouraged by the feedback we have received from WBD shareholders who clearly understand the benefits of our offer. We will continue to move forward to deliver this transaction, which is in the best interest of WBD shareholders, consumers, and the creative industries.”

According to Paramount, its offer provides WBD shareholders “superior value” compared with the transaction with Netflix. Per Paramount, its offer $30 per share in cash versus Netflix’s cash component of only $23.25 per share (an $18 billion difference in the aggregate).

“The value of Netflix’s offer has been further reduced as its share price trades below the bottom of the “collar” on its stock component,” Paramount said. In addition, Netflix’s offer “would leave WBD shareholders owning a highly leveraged stub in Global Networks and WBD’s Board provides no valuation of that stub.” Paramount has estimated the WBD Global Networks business would be worth around $1 per share. According to Paramount, Netflix’s offer has a “dollar-for-dollar reduction to what WBD shareholders will receive tied to the net debt on Global Networks.”

Paramount reiterated that it is “highly confident its offer would receive timely regulatory approval because it would enhance competition in the creative industries rather than entrench a dominant streaming monopoly that the Netflix transaction envisions.” According to the WBD’s board letter to shareholders, “Despite PSKY’s media statements to the contrary, the Board does not believe there is a material difference in regulatory risk between the PSKY offer and the Netflix merger.”

Paramount claimed that it has lined up “all necessary financing to deliver its offer to WBD shareholders, and it is not subject to any financing conditions.” Paramount’s offer will be financed by $41 billion of new equity “backstopped” by the Ellison family (i.e., Oracle co-founder Larry Ellison) and RedBird Capital Partners and $54 billion of debt commitments from Bank of America, Citi and Apollo Global Management.

However, in rejecting Paramount’s $30/share hostile bid, the WBD board said Paramount “has consistently misled WBD shareholders that its proposed transaction has a ‘full backstop’ from the Ellison family. It does not, and never has.” Per the Warner Bros. Discovery board, the most recent Paramount Skydance proposal includes a $40.65 billion equity commitment “for which there is no Ellison family commitment of any kind. Instead, they propose that you rely on an unknown and opaque revocable trust for the certainty of this crucial deal funding.”

Paramount directed WBD shareholders “and other interested parties” to its website with details about its offer at strongerhollywood.com. Netflix, meanwhile, has its own site for shareholders arguing its case, at netflixwbtogether.com.

In its statement Wednesday, Paramount reiterated its belief that the sales process conducted by Warner Bros. Discovery’s board was not conducted fairly. “WBD’s own narrative of the actions that led to its inferior transaction with Netflix reveals a process which was not run to secure the best offer for WBD shareholders,” Paramount Skydance said. “Most notably, the absence of any engagement by WBD with Paramount in the face of a superior all-cash $30 per share offer speaks for itself.”

According to Paramount, “WBD seeks to mislead its shareholders into believing this is a complicated question about legal documents. In reality, it is all quite simple: $30 in cash fully backstopped by a well-capitalized trust (in existence for approximately 40 years) of one of the most well-known founders and entrepreneurs in the world, Larry Ellison.” But from mid-September “all the way through to December 4, what is glaring is the absolute resistance on the part of WBD to even engage in a single negotiating session with Paramount or its advisors, and a refusal even to provide a mark-up of any transaction document,” Paramount Skydance said.

The Netflix transaction requires approval by Warner Bros. Discovery shareholders at a special shareholder meeting. “But there is no reason to wait months to have your voice heard,” Paramount Skydance said, repeating its call for WBD shareholders tender their shares “today” for the Paramount bid. For Paramount’s hostile bid to prevail over the Netflix agreement, Paramount will need to receive at least 90% of the outstanding shares of WBD common stock in favor of its proposal.

Leave a Reply