Warner Bros. Discovery‘s board has formally said “no thanks” to the $108 billion takeover bid from David Ellison’s Paramount Skydance and unanimously reiterated its support for the Netflix deal.

Paramount and Ellison’s financial backers, which include his father, tech billionaire Larry Ellison, will now evaluate the rejection notice from WBD’s board of directors — and then decide whether to make a higher offer.

Warner Bros. Discovery said it remains committed to its megadeal with Netflix, under which the streamer would buy the Warner Bros. studios, HBO and HBO Max for $27.75/share. That would take place after WBD’s planned Q3 2026 spin-off of Discovery Global, largely comprising the company’s TV networks.

Warner Bros. Discovery said Wednesday its board “has unanimously determined that the tender offer launched by Paramount Skydance (‘PSKY’) on December 8, 2025, is not in the best interests of WBD and its shareholders and does not meet the criteria of a ‘Superior Proposal’ under the terms of WBD’s merger agreement with Netflix announced on December 5, 2025.” The Warner Bros. Discovery board “recommends that WBD shareholders reject PSKY’s offer.”

“The terms of the Netflix merger are superior. The PSKY offer provides inadequate value and imposes numerous, significant risks and costs on WBD,” Warner Bros. Discovery’s board says in a letter to shareholders (read it in full below). The company also documents the sequence of interactions with Paramount in a Schedule 14D-9 filing Wednesday with the SEC.

According to the WBD board’s letter, Paramount “has consistently misled WBD shareholders that its proposed transaction has a ‘full backstop’ from the Ellison family. It does not, and never has.”

Per the Warner Bros. Discovery board, the most recent Paramount Skydance proposal includes a $40.65 billion equity commitment “for which there is no Ellison family commitment of any kind. Instead, they propose that you rely on an unknown and opaque revocable trust for the certainty of this crucial deal funding.”

The WBD board letter continues: “Despite having been told repeatedly by WBD how important a full and unconditional financing commitment from the Ellison family was — and despite their own ample resources, as well as multiple assurances by PSKY during our strategic review process that such a commitment was forthcoming — the Ellison family has chosen not to backstop the PSKY offer.” Warner Bros.’s board said a revocable trust is “no replacement for a secured commitment by a controlling stockholder” because the assets and liabilities of the trust are not publicly disclosed and are subject to change.

Furthermore, according to the WBD letter, Paramount’s acquisition offer “can be terminated or amended by PSKY at any time prior to its completion” and is therefore not the same thing as a binding merger agreement.

“The PSKY offer is illusory,” the letter says.

Additionally, the Warner Bros. Discovery board commented on Paramount’s expectation that it can achieve $9 billion in cost synergies ($3 billion from Paramount-Skydance and $6 billion with WBD). “These targets are both ambitious from an operational perspective and would make Hollywood weaker, not stronger,” WBD board’s says. Netflix has identified $2 billion-$3 billion in expected cost synergies.

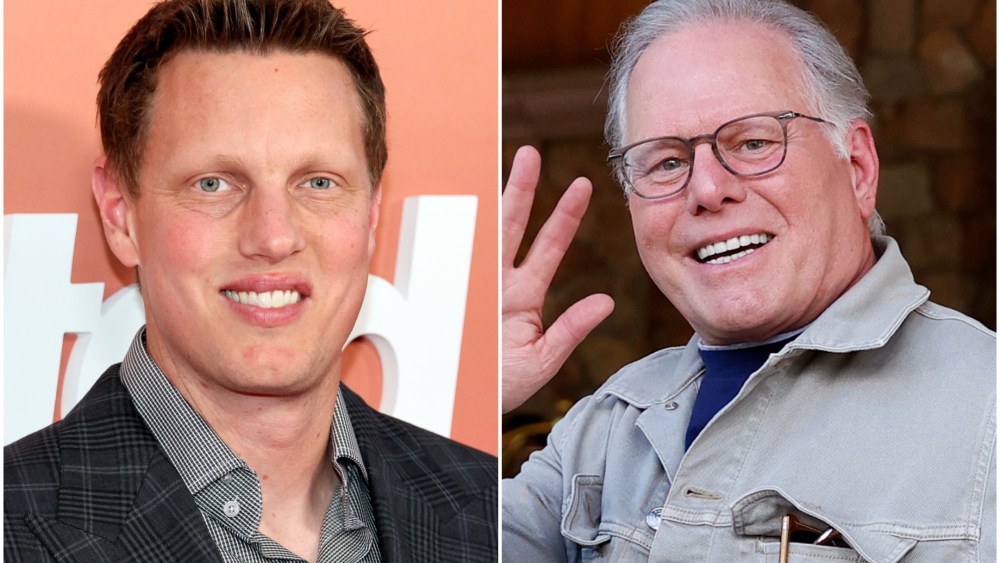

Warner Bros. Discovery chair Samuel Di Piazza Jr. said in a statement: “Following a careful evaluation of Paramount’s recently launched tender offer, the Board concluded that the offer’s value is inadequate, with significant risks and costs imposed on our shareholders. This offer once again fails to address key concerns that we have consistently communicated to Paramount throughout our extensive engagement and review of their six previous proposals. We are confident that our merger with Netflix represents superior, more certain value for our shareholders and we look forward to delivering on the compelling benefits of our combination.”

RELATED: David Ellison Courted Warner Bros. Discovery’s Zaslav Hard Over 12 Weeks to Win a Deal. Then WBD’s Chief Stopped Responding to His Texts

On Wednesday, Netflix released a statement saying it “welcomes” the WBD board’s recommendation. It also pointed to its website, netflixwbtogether.com, touting the benefits of its deal with Warner Bros.

“The Warner Bros. Discovery Board reinforced that Netflix’s merger agreement is superior and that our acquisition is in the best interest of stockholders,” said Ted Sarandos, Netflix co-CEO, in a statement. “This was a competitive process that delivered the best outcome for consumers, creators, stockholders and the broader entertainment industry.” Netflix co-CEO Greg Peters added: “By acquiring Warner Bros., we’ll be able to offer audiences and creators around the world even more choice, value and opportunity. This transaction is fundamentally pro-consumer, pro-innovation, pro-creator and pro-growth.”

Over the course of 12 weeks, Ellison had proffered an increasingly aggressive series of bids for Warner Bros. Discovery in its entirety, starting at $19/share Sept. 14 and most recently offering $30/share as of Dec. 4. After WBD picked Netflix as the winning bidder, Ellison on Dec. 8 launched a hostile takeover maneuver, announcing that Skydance was taking its offer for all of Warner Bros. Discovery directly to shareholders.

In prior communications to the Paramount team, WBD’s board had expressed concerns that Paramount’s Dec. 1 bid — backed by the sovereign wealth funds of Saudi Arabia, Qatar and Abu Dhabi, as first reported by Variety — would trigger a problematic national security review by the U.S. government because of the foreign investors. Paramount Skydance’s bid also was being backed by Affinity Partners, the investment firm founded by Jared Kushner, who is Donald Trump’s son-in-law. To address these concerns, Paramount disclosed in an SEC filing, the three Arab wealth funds and Kushner’s Affinity “agreed to forgo any governance rights — including board representation — associated with their non-voting equity investments.” On Tuesday, Kushner’s Affinity Partners said it was no longer participating in Paramount’s hostile takeover bid for WBD.

Paramount claimed that if the Middle Eastern wealth funds dropped out, the Ellison family and RedBird Capital Partners would “backstop the full amount of the equity financing” of its bid. As of Dec. 16, Larry Ellison’s net worth was approximately $240 billion, per Forbes. As noted in the WBD shareholder letter, Paramount’s equity financing commitment is backed by the Lawrence J. Ellison Revocable Trust.

More broadly, Paramount has argued that its $30/share offer is a better deal for WBD shareholders than Netflix’s starting with the fact that it’s all-cash, compared with Netflix’s agreement that is 84% cash.

Paramount also has asserted that a Paramount-WBD merger would have a clearer path to regulatory approval compared with Netflix, which would amass even more power in the premium video streaming market through the takeover of HBO Max. According to the letter to WBD’s board to shareholders, “Despite PSKY’s media statements to the contrary, the Board does not believe there is a material difference in regulatory risk between the PSKY offer and the Netflix merger.”

For their part, Netflix execs have expressed confidence they will obtain all necessary approvals to close the deal.

According to Paramount, WBD is overvaluing the TV networks group (which is excluded from the Netflix deal). Because WBD went with Netflix’s bid, that implies WBD is ascribing a value of at least $2.25/share to the TV networks group. But Paramount argues that the value of WBD’s networks group is in fact much lower: roughly $1/share, working out to an equity valuation of about $2.6 billion, assuming the spun-off entity will have a 3.5x net debt-to-EBITDA ratio. However, at a lower leverage ratio, Discovery Global would have a higher market value — to the point where the Netflix terms plus the Discovery Global valuation would exceed $30/share, according to an analysis by Wall Street firm MoffettNathanson.

President Trump, meanwhile, has said he will be “involved” in a Warner Bros. deal review. Trump, who has been palsy with the Ellisons, has in recent weeks lashed out at them over his perceived mistreatment by CBS News’ “60 Minutes” and wrote in a Dec. 15 social-media post, “If they are friends, I’d hate to see my enemies!”

Read Warner Bros. Discovery’s letter to shareholders explaining its rejection of the Paramount Skydance offer:

Dear Fellow Shareholders,

As your Board of Directors, we are committed to acting in your best interest. In this spirit, in October, we launched a public review of strategic alternatives to maximize shareholder value. This followed three separate proposals from Paramount Skydance (“PSKY”), as well as interest from multiple other parties.

That thorough process, overseen by the Board with the assistance of independent financial and legal advisors, as well as our management team, led to the company entering into a merger agreement with Netflix on December 4, with the substantial benefits to WBD shareholders described below. Having failed to submit the best proposal for you, our shareholders, PSKY launched an offer nearly identical to its most recently rejected proposal.

As a Board, we have now conducted another review and determined that PSKY’s tender offer remains inferior to the Netflix merger. The Board continues to unanimously recommend the Netflix merger, and that you reject the PSKY offer and not tender your shares.

Below, and in more detail in our 14D-9 filing, we highlight the many reasons for the Board’s determination. None of these reasons will be a surprise to PSKY given our clear, and oft- repeated, feedback on their six prior proposals.

The terms of the Netflix merger are superior. The PSKY offer provides inadequate value and imposes numerous, significant risks and costs on WBD.

The value we have secured for shareholders through the Netflix merger is extraordinary by any measure.

Our agreement with Netflix gives WBD shareholders $23.25 in cash, plus $4.50 in shares of Netflix common stock (based on a collar range of $97.91 – $119.67 in the Netflix stock price at the Ume of closing), plus the additional value of the shares of Discovery Global and the opportunity to participate in future potential upside following Discovery Global’s separation from WBD. The entire Board is confident in our recommendation that Netflix represents the best value-creating path for shareholders.

PSKY has consistently misled WBD shareholders that its proposed transaction has a “full backstop” from the Ellison family. It does not, and never has.

PSKY’s most recent proposal includes a $40.65 billion equity commitment, for which there is no Ellison family commitment of any kind. Instead, they propose that you rely on an unknown and opaque revocable trust for the certainty of this crucial deal funding. Despite having been told repeatedly by WBD how important a full and unconditional financing commitment from the Ellison family was – and despite their own ample resources, as well as multiple assurances by PSKY during our strategic review process that such a commitment was forthcoming – the Ellison family has chosen not to backstop the PSKY offer.

And a revocable trust is no replacement for a secured commitment by a controlling stockholder. The assets and liabilities of the trust are not publicly disclosed and are subject to change. As the name indicates, revocable trusts typically have provisions allowing for assets to be moved at any time. And the documents provided by PSKY for this conditional commitment contain gaps, loopholes and limitations that put you, our shareholders, and our company at risk.

Amplifying the concerns about the credibility of the equity commitment being offered by PSKY, the revocable trust and PSKY have agreed that the trust’s liability for damages, even in the case of a willful breach, would be capped at 7% of its commitment ($2.8 billion on a $108.4 billion transaction). Of course, the damage to WBD and its stockholders were the trust or PSKY to breach their obligations to close a transaction would likely be many multiples of this amount.

WBD’s merger agreement with Netflix is a binding agreement with enforceable commitments, with no need for any equity financing and robust debt commitments. The Netflix merger is fully backed by a public company with a market cap in excess of $400 billion with an investment grade balance sheet. The debt financing for the PSKY bid relies on an unsecure revocable trust commitment as well as the credit worthiness of a $15 billion market cap company with a credit rating at or only a notch above “junk” status from the two leading rating agencies. The financial condition and creditworthiness of PSKY, which, if its proposed transaction were to close, would have a high gross leverage ratio of 6.8x 2026E debt to EBITDA with virtually no current free cash flow generation before synergies, raise substantial risks for its acquisition of WBD. Such debt levels reflect a risky capital structure that is vulnerable to even potentially small changes in the PSKY or WBD business between signing and closing.

Additionally, PSKY contemplates $9 billion in synergies from the mergers of Paramount/Skydance and their offer for WBD. These targets are both ambitious from an operational perspective and would make Hollywood weaker, not stronger.

The Board’s review was full, transparent and competitive – establishing a level playing field that fostered a rigorous and fair process.

The Board repeatedly engaged with all parties, including extensive engagement with PSKY and its advisors over the course of nearly three months. We held dozens of calls and meetings with its principals and advisors including four in-person meetings and meals between David Zaslav and David and/or Larry Ellison and provided multiple opportunities for PSKY to offer a proposal that was superior to those of the other bidders, which PSKY never did.

After each bid, we informed PSKY of the material deficiencies and offered potential solutions. Despite this feedback, PSKY has never submitted a proposal that is superior to the Netflix merger agreement.

Despite PSKY’s media statements to the contrary, the Board does not believe there is a material difference in regulatory risk between the PSKY offer and the Netflix merger.

The Board carefully considered the federal, state, and international regulatory risks for both the Netflix merger and the PSKY offer with its regulatory advisors. The Board believes that each transaction is capable of obtaining the necessary U.S. and foreign regulatory approvals and that any difference between the respective regulatory risk levels is not material. The Board also notes that Netflix has agreed to a record-setting regulatory termination cash fee of $5.8 billion, significantly higher than PSKY’s $5 billion break fee.

The PSKY offer is illusory.

The offer can be terminated or amended by PSKY at any time prior to its completion; it is not the same thing as a binding merger agreement. The first paragraph of the offer states it is “subject to the conditions set forth in this offer to purchase (as it may be amended or supplemented from time to time)” and continues on the next page, “we reserve the right to amend the Offer in any respect (including amending the Offer Price)”. In addition, the offer is not capable of being completed by its current expiration date, due to the need for, among other things, global regulatory approvals, which PSKY indicates may take 12-18 months. Nothing in this structure offers WBD shareholders any deal certainty.

The PSKY offer provides an untenable degree of risk and potential downside for WBD shareholders.

There will be additional costs associated with PSKY’s offer that could impact shareholders.

When considering the PSKY offer at this juncture, it is important to note that its acceptance could incur significant additional costs to shareholders – all of which PSKY has ignored in their communications. WBD would have to pay Netflix a $2.8 billion termination fee, which PSKY has not offered to reimburse. In addition, WBD would incur approximately $1.5 billion in financing costs if we do not complete our planned debt exchange as agreed to with certain of our debtholders, which would not be permitted by the PSKY offer. This additional $4.3 billion in potential costs represents approximately $1.66 per share to be borne by WBD shareholders if the offer does not close.

We look forward to moving ahead with our combination with Netflix and delivering the compelling and certain value it will create for shareholders. We urge you to carefully read the 14D-9 filed with the SEC this morning and available on our website, which more fully details the strategic review process and the Board’s reasons for its recommendation to you.

Sincerely,

The Warner Bros. Discovery Board of Directors

Leave a Reply